By James Warden

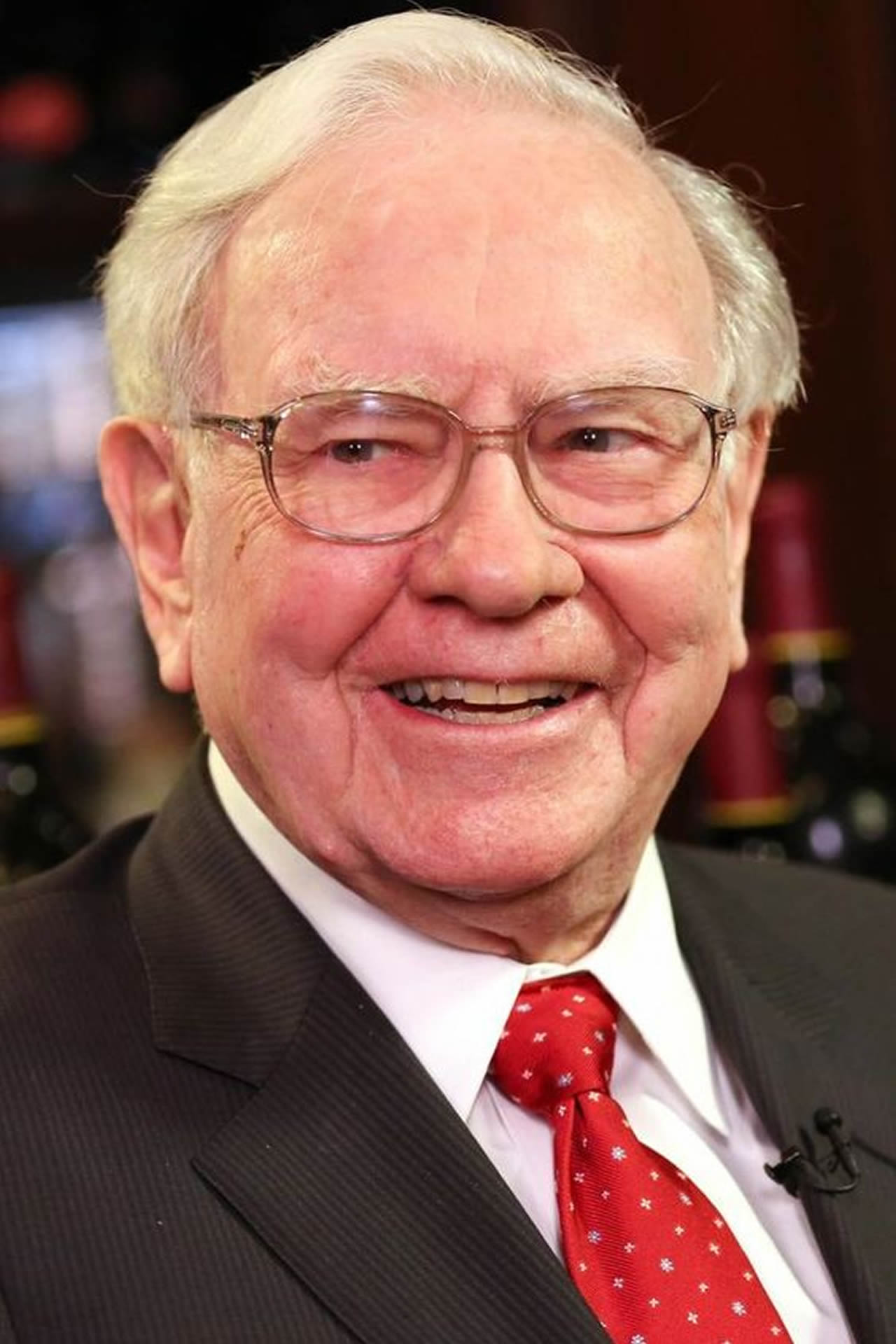

Most people try to invest and make money, but they frequently lose money because they keep making the same mistakes. Wannabe investors should strive to study and imitate the mentalities of wealthy people like Warren Buffet, Michael Dell, Bill Gates, and Mark Zuckerberg. Let's concentrate on Warren Buffet, who has been called the world's best investor. He follows some of the following investment advice:

1. Establish an investment attitude

Although not everyone has a business-oriented mindset, reading books on business can help us develop our business skills. Warren Buffet spends a lot of time reading books on business.

2. Exercise patience when making investments

Buffett invests in the company every time he buys a share of stock. In other words, he doesn't sell the shares with every market upswing or downturn. He stays onto equities until he no longer finds value in the firms he invests in or believes in them on a long-term basis. One of Warren Buffett's well-known comments, which highlights his preference for long-term investments, is: “No matter how amazing the skill or attempt, certain things just call for a substantial investment. By making nine women pregnant in one month, you cannot produce a child.”

3. Put value first

Sometimes, the price we pay and the value we receive from our purchase are unrelated. Buffett thinks that investors need to realize that supply and demand govern markets and that investing in a firm with strong growth amid market downturns is a fantastic way to increase one's wealth. Purchase a quality stock at a discount.

4. When investing, control your emotions.

More than any financial model, human emotions greatly affect the market. People's emotions can give them hope for something that has never happened or happens only occasionally. According to Buffett, self-controlling your emotions is far more important than having a high IQ. He claims that “Investment success does not correlate with intelligence. What you need is the attitude to restrain the investing inclinations that injure other people “.

5. Invest in the things that interest and inform you.

“Never put resources into a business you don't get,” advises Buffett. Don't invest in businesses whose operations you are unfamiliar with.

It is considerably more challenging to predict a company's future development and predict how it will perform over the long term without sufficient knowledge about the organization.

6. Budget your money

Despite having an estimated $87 billion in wealth, Buffett lives in a startlingly modest house. He paid $31,500 for his current Omaha, Nebraska, home in 1958, and he currently ranks it as his third best investment. Buffett chooses to live modestly rather than squander money on extravagant lifestyles, and he has reaped the rewards.

7. Prioritize saving over spending.

People frequently pay their payments first, then spend the remainder before saving. Buffett thinks this is the incorrect strategy. Buffet advises setting away a predetermined sum of money each month for savings, paying your bills next, and then spending the remaining funds.

8. Keep your roots in mind

Buffett got a job as a paperboy delivering The Washington Post while he was a middle school student. He developed his early involvement with the daily newspaper into a lifelong friendship. Years later, Berkshire Hathaway, his business, rose to become the Washington Post's largest shareholder. Keep in mind your origins and core principles, and you might find rare possibilities to make excellent investments.